Planning your estate

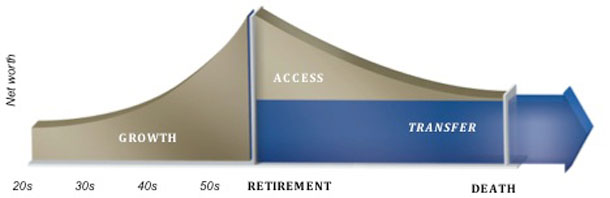

THUNDER BAY – MONEY – It’s quite possible you haven’t started planning what your estate with look like, as it’s not really something most people want to think about. When it comes to your net worth, it’s quite possible some of it won’t be used in your lifetime. With that in mind it’s important to consider things like the tax that would be generated from your non-registered or registered investments, and capital gains from second or third homes, should something happen to you.

If your plan or goal is to transfer or leave those as assets, it’s important to consider two things. What will the taxes be upon the wealth transfer and are you maximizing what your estate is worth?

How permanent insurance can maximize your wealth

Unlike those investments or assets that may result in taxes from growth, interest, dividends or capital gains, permanent insurance policies provide your estate with immediate insurance as well as tax-advantaged accumulation with limits. Using some of your liquid assets to pay the premiums of a permanent policy structures the disbursement of your assets in a tax efficient manner to maximize your wealth.

Ultimately, this is allowing for the tax free ownership of the policy and all its accumulated cash value to be given to your beneficiaries or heirs. Using this strategy properly can help ensure you’re maximizing your estate and the wealth that is transferred to future generations.

How Estate Planning benefits you

Using this strategy benefits you by generating after-tax estate value instead of taxable income. It allows you to reduce your annual taxes in the case of non-registered investments, and maintain control of your assets within the policy. Even though you are unlikely to ever need the money yourself, you do have access to it if need be.

How this benefits your estate

Using the money you were already going to leave in your estate, you have maximized what your estate could be worth. This will help with any taxes that may be payable on your estate from registered investments or the capital gains from your second or third home.

The Bottom Line

This is just one strategy that helps maximize what your estate could be worth, and should not be considered the only one. Everyone’s situation is different, but if this strategy seems like something that interests you, don’t hesitate to call or email me directly.

If you would like to sign up for my free monthly investment newsletter, feel free to email me at anthony.talarico@f55f.com with your name and email.

Anthony M. Talarico

Financial Security & Investment Representative

W: 807-343-4788 C: 807-472-6092

Please Note: The contents shouldn’t be taken as providing legal, accounting or tax advice. You should obtain your own independent professional advice from your lawyer and/or accountant to take into account your particular circumstances.