In the ever-changing world of foreign currency trading, dealers must decide whether to use a long-term or short-term strategy. Internet trading giant Bitogrand recognizes the diversity of trading styles and caters to a wide range of traders. This inquiry examines the platform’s views on long-term and short-term forex trading strategies, including their pros, cons, and key variables.

Long-term Bitogrand forex trading

Several advantages

-

Low-impact market noise

Long-term trading on Bitogrand lets traders ignore market noise and focus on larger patterns. This approach supports the platform’s objective of providing broad analytical tools for long-term traders to conduct fundamental and technical investigations.

-

Faster one

Compared to short-term trading, long-term trading requires less time. The platform’s user-friendly interface and automated tools allow long-term traders to manage their portfolios with little daily involvement. Traders with busy schedules benefit from this.

-

Possible Compound Earnings

Long-term trading at the company is consistent with compounding benefits. Because traders hold positions longer, they may profit from compounding gains, especially when reinvesting their wins. The platform’s risk management capabilities let traders weather market volatility with a disciplined long-term plan.

Challenges

-

Self-control and patience

Long-term trading requires patience and self-control. Traders must resist making hasty decisions based on short-term market developments. Bitogrand provides risk management and educational tools to help long-term traders stay disciplined.

-

Over Time Market Exposure:

Long-term trading mitigates short-term market volatility, but traders are exposed to long-term trends, which may not be good. Long-term traders need the company’s range of tradable assets and risk management capabilities to adapt to market changes.

Short-Term Forex Trading on Bitogrand

Several advantages

-

Profiting from Market Intraday Movements

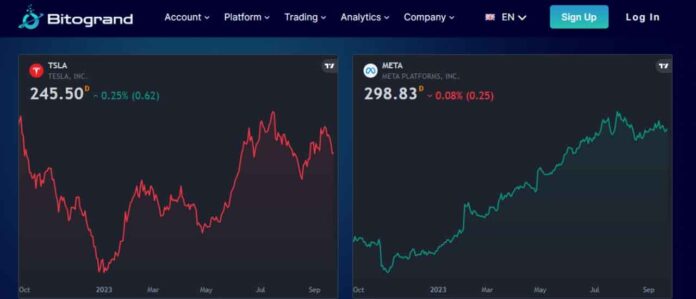

Short-term trading on the platform lets traders benefit from intraday market movements. The platform’s real-time market data and technical analysis tools help short-term traders see and act on trends, patterns, and price shifts.

-

Ability to adapt and change

Bitogrand’s focus on a user-friendly interface and cutting-edge technology matches short-term traders’ need for flexibility. Short-term traders can adapt to changing market conditions owing to the platform’s flexible design and fast execution.

-

Opportunities arise from volatility

Short-term trading thrives in volatile markets. The platform’s asset classes allow short-term traders to benefit from market volatility. These assets include cryptocurrency and currency pairs. The platform’s risk management helps control short-term trading hazards.

Challenges

-

Time-consuming traits

Short-term trading involves big personal time investments. Bitogrand realizes the complexity of this circumstance and provides automation solutions to help short-term traders set trade execution requirements. However, short-term trading is fast-paced and requires constant attention and quick judgments.

-

Transaction Costs

The frequency of transactions may raise short-term strategy transaction costs. The company’s straightforward fee structure and low spreads help short-term traders manage their spending. The platform’s risk management capabilities let traders match position sizes to their risk tolerance.

The Most Important Bitogrand Trading Considerations

-

Tools and Resources for Analysis

The company provides a wide range of analytical tools for every trading horizon. Whether they are trading short-term or long-term, traders should utilize the platform’s real-time market data, technical analysis tools, and fundamental resources to make educated decisions.

-

Risk Management

Bitogrand stresses risk management for long-term and short-term traders. Stop-loss and take-profit orders are platform risk management features. These features help traders avoid losses and safeguard their money.

-

Educational Contributions

The fact that the platform provides instructional resources shows its commitment to user education. Regardless of experience, the platform’s training, webinars, and market insights benefit traders. This guidance aids in foreign currency market understanding and trading method improvement.

Conclusion

Trading for long or short periods depends on an individual’s preferences, risk tolerance, and trading goals in the Bitogrand ecosystem. The platform ensures traders can implement their strategies by providing a technologically advanced and user-friendly environment.