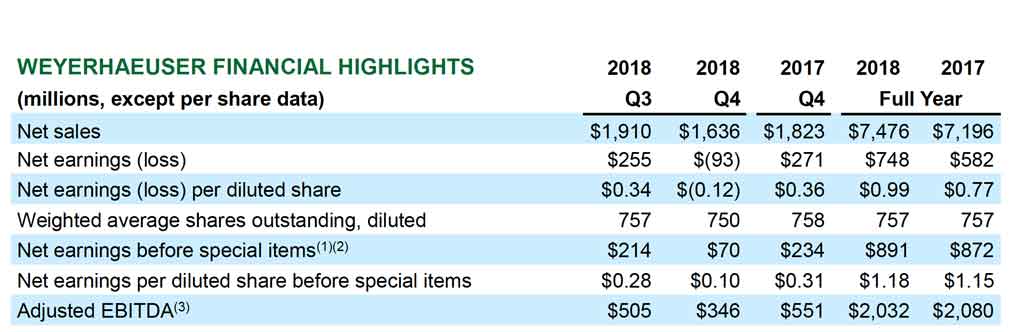

SEATTLE – Business – Weyerhaeuser Company (NYSE: WY) today reported a fourth-quarter net loss of $93 million, or 12 cents per diluted share, on net sales of $1.6 billion. This compares with net earnings of $271 million, or 36 cents per diluted share, on net sales of $1.8 billion for the same period last year and net earnings of $255 million for the third quarter of 2018.

View our earnings release and financial statements in a printer-friendly PDF.

Fourth quarter includes net after-tax charges of $163 million for special items, primarily a non-cash settlement charge related to a previously announced action to reduce our pension liabilities. Excluding special items, the company reported net earnings of $70 million, or 10 cents per diluted share, for fourth quarter 2018. This compares with net earnings before special items of $234 million for the same period last year and $214 million for the third quarter of 2018.

For the full year 2018, Weyerhaeuser reported net earnings of $748 million, or 99 cents per diluted share, on net sales of $7.5 billion. This compares with net earnings of $582 million on net sales of $7.2 billion for the full year 2017.

Full year 2018 includes net after-tax charges of $143 million from special items. Excluding these items, the company reported net earnings before special items of $891 million, or $1.18 per diluted share. This compares with net earnings before special items of $872 million for the full year 2017.

“In 2018 we delivered strong results through a wide range of market conditions, generating over $2 billion of Adjusted EBITDA, returning nearly $1.4 billion to shareholders through dividends and share repurchases, and significantly reducing our pension liabilities,” said Devin W. Stockfish, president and chief executive officer. “Entering 2019, U.S. economic fundamentals remain strong and we expect continued growth in U.S. housing. We remain focused on driving value for shareholders through operational excellence and disciplined capital allocation.”

4Q 2018 Performance – In the West, lower average log sales realizations were partially offset by higher sales volumes across domestic and export markets. Western road spending increased as favorable weather allowed the company to complete previously deferred activity. In the South, fee harvest volumes increased due to higher stumpage sales, and average log sales realizations were comparable to the third quarter.

1Q 2019 Outlook – Weyerhaeuser expects first quarter earnings and Adjusted EBITDA will be lower than the fourth quarter. In the South, the company anticipates seasonally lower fee harvest volumes and comparable average log sales realizations. In the West, the company expects lower fee harvest volumes and average log sales realizations moderately below the fourth quarter average, mostly offset by significantly lower road and forestry spending.

4Q 2018 Performance – Earnings and Adjusted EBITDA increased compared with the third quarter. Real Estate EBITDA was higher due to the regional mix of properties sold. Average land basis decreased modestly.

1Q 2019 Outlook – Weyerhaeuser anticipates earnings and Adjusted EBITDA will increase in the first quarter due to the timing of Real Estate transactions. Royalties from Energy and Natural Resources operations should be seasonally lower. The company anticipates full year 2019 Adjusted EBITDA for the segment of approximately $260 million.

4Q 2018 Performance – Earnings and Adjusted EBITDA decreased compared with the third quarter, primarily due to a 21 percent decline in average sales realizations for lumber and oriented strand board. Sales volumes and operating rates for lumber and engineered wood products decreased seasonally, and unit manufacturing costs were higher. Sales volumes for oriented strand board were comparable to the third quarter. Third quarter volumes were lower than normal due to a scheduled press replacement at our Grayling, Michigan mill, which was completed in late October.

Fourth quarter results include a minimal benefit from lower Western and Canadian log prices as the costs of sales includes logs purchased in the third quarter when prices were higher.

1Q 2019 Outlook – Weyerhaeuser anticipates first quarter earnings and Adjusted EBITDA will be significantly higher than the fourth quarter. The company expects seasonally higher sales volumes, higher operating rates, improved unit manufacturing costs and additional benefit from the fourth quarter decrease in Western and Canadian log prices.

4Q 2018 Performance – Fourth quarter results include benefits from elimination of intersegment profit in inventory and LIFO, favorable year-end employee benefits adjustments and foreign exchange gains.

Fourth quarter pre-tax special items include a non-cash charge of $200 million related to completion of a previously announced terminated vested lump sum offer for our U.S. pension plan and a $13 million gain on the sale of a nonstrategic asset.

In January 2019, Weyerhaeuser transferred approximately $1.5 billion of U.S. pension assets and liabilities to an insurance carrier through the purchase of a group annuity contract. The transaction was funded with assets held by the U.S. pension plan and there will be no change to pension benefits for transferred participants. In connection with this transaction, the company expects to recognize a non-cash pre-tax pension settlement charge of approximately $450 million in the first quarter of 2019.

ABOUT WEYERHAEUSER

Weyerhaeuser Company, one of the world’s largest private owners of timberlands, began operations in 1900. We own or control 12.2 million acres of timberlands in the U.S., and manage additional timberlands under long-term licenses in Canada. We manage these timberlands on a sustainable basis in compliance with internationally recognized forestry standards. We are also one of the largest manufacturers of wood products. Our company is a real estate investment trust. In 2018, we generated $7.5 billion in net sales and employed approximately 9,300 people who serve customers worldwide. We are listed on the Dow Jones Sustainability North America Index. Our common stock trades on the New York Stock Exchange under the symbol WY. Learn more at www.weyerhaeuser.com.

EARNINGS CALL INFORMATION

Weyerhaeuser will hold a live conference call at 7 a.m. Pacific (10 a.m. Eastern) on February 1, 2019 to discuss fourth quarter results.

To access the live webcast and presentation online, go to the Investor Relations section on www.weyerhaeuser.com on February 1, 2019.

To join the conference call from within North America, dial 855-223-0757 (access code: 6872608) at least 15 minutes prior to the call. Those calling from outside North America should dial 574-990-1206 (access code: 6872608). Replays will be available for two weeks at 855-859-2056 (access code: 6872608) from within North America and at 404-537-3406 (access code: 6872608) from outside North America.

FORWARD LOOKING STATEMENTS

This news release contains statements concerning the company’s future results and performance that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, including with respect to the following for the first quarter of 2019: earnings and Adjusted EBITDA for each of our business segments; pension settlement charges; log sale realizations; fee harvest volumes and road and forestry spending in our timber business; Wood Products sales volumes and realizations and operating rates; real estate sales volumes; and royalties from energy and natural resources operations. These statements generally are identified by words such as “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” and expressions such as “will be,” “will continue,” “will likely result,” and similar words and expressions. These statements are based on our current expectations and assumptions and are not guarantees of future performance. The realization of our expectations and the accuracy of our assumptions are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include, but are not limited to:

- the effect of general economic conditions, including employment rates, interest rate levels, housing starts, availability of financing for home mortgages and strength of the U.S. dollar;

- market demand for our products, including market demand for our timberland properties with higher and better uses, which is related to, among other factors, the strength of the various U.S. business segments and U.S. and international economic conditions;

- changes in currency exchange rates, particularly the relative value of the U.S. dollar to the Japanese yen, the Chinese yuan and the Canadian dollar, and the relative value of the euro to the yen;

- restrictions on international trade and tariffs imposed on imports or exports;

- the availability and cost of shipping and transportation;

- economic activity in Asia, especially Japan and China;

- performance of our manufacturing operations, including maintenance requirements;

- potential disruptions in our manufacturing operations;

- the level of competition from domestic and foreign producers;

- raw material availability and prices;

- the effect of weather;

- the risk of loss from fires, floods, windstorms, hurricanes, pest infestation and other natural disasters;

- energy prices;

- the successful execution of our internal plans and strategic initiatives, including restructuring and cost reduction initiatives;

- the successful and timely execution and integration of our strategic acquisitions, including our ability to realize expected benefits and synergies, and the successful and timely execution of our strategic divestitures, each of which is subject to a number of risks and conditions beyond our control including, but not limited to, timing and required regulatory approvals;

- transportation and labor availability and costs;

- federal tax policies;

- the effect of forestry, land use, environmental and other governmental regulations;

- legal proceedings;

- performance of pension fund investments and related derivatives;

- the effect of timing of retirements and changes in the market price of our common stock on charges for share-based compensation;

- changes in accounting principles; and

- other matters described under “Risk Factors” in our annual reports on Form 10-K, as well as those set forth from time to time in our other public statements and other reports and filings with the Securities and Exchange Commission.

Forward-looking statements speak only as of the date they are made, and we undertake no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events, or otherwise.

For more information contact:

Analysts – Beth Baum, 206-539-3907

Media – Nancy Thompson, 919-861-0342