THUNDER BAY – BUSINESS – The holidays are a busy time for many small businesses; so much so that the typical January lull is a chance for entrepreneurs to catch their breath. As we approach the end of the year and the beginning of a new one, the hustle and bustle of December leads into another chapter for your small business. The great holiday rush is followed by the inevitable tax season.

The Thunder Bay Community Economic Development Commission (CEDC)/Thunder Bay and District Entrepreneur Centre (EC) is an entrepreneurial support organization dedicated to get you on the right track to success. Their one-to-one counseling can assist you to write a business plan, secure funding, market your products and services, and connect you with other available resources, such as accounting firms.

While corporations operate within their own fiscal cycle, unincorporated businesses follow the same timeline as the rest of us, having to file before the end of April. Jennifer Whelan, Tax Partner at BDO, and her team of tax specialists work with local businesses every year to get their taxes filed before the April 30th deadline. “Most business owners take about a month to get organized after the Christmas rush, and come February, they will get their documentation in for us to file their taxes for them.”

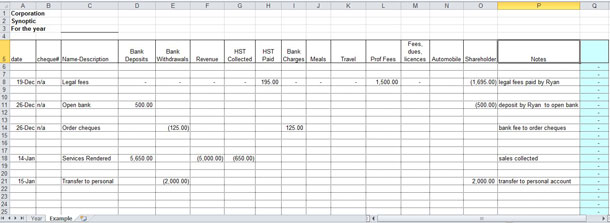

‘Getting organized’ refers to compiling receipts, invoices, and putting other filing in order and summarizing the information in a spreadsheet. Jennifer tells, “Most small businesses with 1-2 employees do not need accounting software. All they need is an Excel spreadsheet to document their finances until their business grows to the next level.”

Larger-sized businesses with more complex finances often utilize programs such as Simply Accounting.

Your spreadsheet should summarize your bank charges, debits and credits, your revenue and expenses, as well as your collected and paid amounts of HST with room for notes.

|

Other little-known tax and accounting tips from Jennifer include the following:

- Pay yourself first

Entrepreneurship does not come with a pension, and small business owners have to protect themselves by making an extra effort to save. Jennifer advises small business owners to tuck away about 10% of their yearly earnings for retirement in a Tax Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP).

- Buy now, sell later

If you’re thinking of buying new equipment or a company vehicle, make that big-ticket purchase before year-end. You will be able to claim that expense now, and get the write-off this year, showing less income and paying less tax.

Conversely, wait until January (next year) to sell off any assets, so that your business is able to claim depreciation and other asset-related expenses as write-offs this year. You cannot claim these expenses on an asset if you no longer own it, so push that sale to the next year and claim the associated write-offs now.

- Do not overclaim

Business owners, particularly those with home-based businesses, tend to overstate how much of the use of their homes and vehicles can be expensed for business purposes, not realizing that the tax law only allows for a portion of these expenses to be claimed.

A home-based business can only claim a portion of their housing expenses, based on the square footage of their home office or workspace as a percentage of the home’s total square footage. Jennifer continues, “The amount you claim for housing your home business must be calculated as a percentage of the total size of the home. When it comes to the expense of your vehicle, the amount claimed is based on kilometres driven for business purposes.”

Jennifer advises entrepreneurs to keep a log of their mileage for the most accurate deductions.

- Register for HST

Businesses whose sales are less than $30,000 per year are not required by law to charge HST on their goods and services. However, once they exceed this amount, they have to submit HST on all sales. “The biggest mistake business owners make is not registering for HST, and when they unexpectedly hit that $30,000 mark, they have to turn over a lot of money that they hadn’t been collecting.”

Jennifer advises small businesses to register for HST regardless of their size. “Consumers expect to pay HST on purchases, and once a business is registered, the business owner can claim all the HST they pay, and be reimbursed.”

- Make the deadline

Don’t be late on your taxes! The penalties for missing the April 30th deadline are quite severe; more than what most small businesses can reasonably afford. For a business that fails to file a tax return, the government will apply a penalty of 5-10% of what you owe, and increase it by 1-2% per month that you are overdue. The government will also charge another 5% per year in interest.

Businesses that fail to file their taxes will face these high fines which may become so unmanageable they can possibly lead to bankruptcy. Jennifer recommends submitting your documentation to your accountant by the end of February to get it off your plate.

- Leave it to the pros

Designated accountants know the ins & outs of the tax laws, and having your taxes filed by a reputable firm can save you money and reduce the chance of being reassessed on audit. Entrepreneurs who prefer to file their own taxes are may be missing out on tax breaks.

In the case that your business is audited, you will likely pay less in interest and penalties if your taxes were filed by a professional accountant or tax specialist.

Looking forward to next year, there will be many changes to corporate tax rates under the new leadership of the Liberal party, and small businesses should be prepared for a possible increase in taxes. Talk to your accountant to learn more about how to maximize your tax efficiency.

The Thunder Bay and District Entrepreneur Centre (EC) offers FREE and confidential services to help small businesses start up, expand, and succeed. The Entrepreneur Centre can assist with writing a business plan, securing funding, marketing your products and services, and accessing other available resources in the community. They also provide free workshops and training seminars to equip and empower small businesses to perform the best they can. For more information or to schedule an appointment, call (807)625-3960 or visit www.EntrepreneurCentre.ca.

|

|

Small businesses of only 1 or 2 employees can usually summarize their financial information in an Excel spreadsheet, without the need for accounting software.

Small businesses of only 1 or 2 employees can usually summarize their financial information in an Excel spreadsheet, without the need for accounting software.