THUNDER BAY – Business – Regular investing is a strategy that requires a lot of discipline. Regular investing is a strategy that uses a save first, spend later mentality, rather than spending first and trying and save the rest.

Many investors use this strategy because it can be easier to do and can also be more rewarding long-term.

Regular Investing vs. Lump-sum Investing

Using this type of strategy allows for continuous investing regardless of market performance, as all of the rises and dips in the markets are purchased. The shorter the time frame by which you regularly invest the better the results will become.

Lump-sum investing requires you to save and then invest which can be more difficult to budget for the average investor.

Why is regular investing better?

The advantage of regular investing is that it allows you to invest smaller amounts of money on a shorter time frame. This will be easier to budget for and allows for dollar cost averaging, so you don’t need to worry about the right time to buy because you’re always investing.

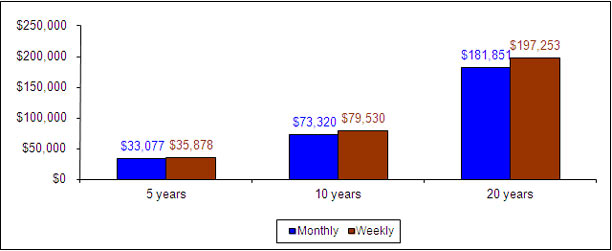

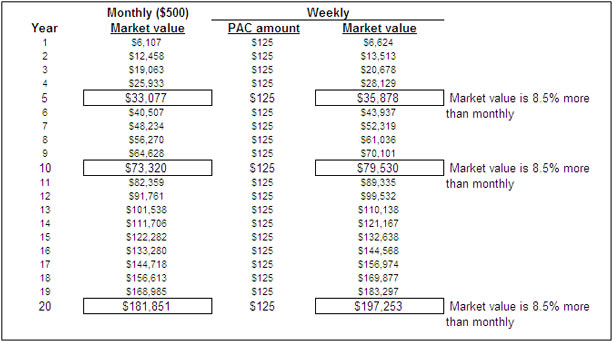

Your money starts working for you immediately instead of saving it first which helps maximize returns. Let’s compare using a chart that shows weekly contributions vs. monthly contributions. For this example, we’ll keep a conservative approach and assume a return of 4% annually.

Instead of trying to accumulate one big lump sum before investing, you can budget for smaller amounts on shorter time frames.

As you widen the time frames between investing, the difference grows substantially. The frequency to which you contribute depends on your overall goals and needs, but structuring it this way will provide you with the greatest results.

The Bottom Line

Most investors believe you need a lump sum to start investing, but the fact remains that is not the case. The more frequent you save and invest your money and the younger you begin making this commitment, the greater results you will achieve. Even those of you who are conservative investors, you can still achieve great results using this strategy.

Anthony Talarico