THUNDER BAY – The 2012 budget for the City of Thunder Bay is shaping up to be a very interesting and watershed set of discussions. Over the period 1999-2010, the average annual growth rate in residential tax property revenues has been 5.1 percent. That for business property tax revenues has been 1.6% while user fee revenues (which include the water bill) has been 6.6 percent.

Despite these revenue increases, the demands for more spending have been incessant. For 2012, the City Police and the District Social Service Board are each asking for increases of more than one million dollars in their budgets while the Superior North EMS says it needs a new ambulance service, which will also cost one million dollars. Thunder Bay Fire and Rescue wants to implement a plan for new fire stations, which is on top of several million dollars in new infrastructure spending. To top it all off, while the decision to build the multiplex has yet to be made, money is being spent on planning for it and the plan is to “leverage funding” for it once it is built – which could ultimately mean borrowing more.

City Council has been rather strategic in its behaviour towards raising taxes for 2012. The fall saw a discussion over a property tax increase to deal with infrastructure under the rubric of Renew Thunder Bay and resulted in a planned 1.5 percent increase in property taxes to deal with infrastructure. That out of the way, the debate is now over what additional increase is needed to deal with everything with at least one city councilor mentioning in a recent media story that while a zero percent increase in unrealistic, the hope was that the jump would be less than 1.5 percent.

City councilors must no doubt be congratulating themselves on their cleverness. After all, the debate has now been structured over whether the increase is going to be 1 or 1.5 or perhaps 2 percent which may not sound so bad except it is on top of the 1.5 percent increase that is already planned and probably does not include increases in fees for things like water. This type of compartmentalization into separate revenue categories – each of which results in a small increase – must assume that the average municipal citizen is rather short sighted if not innumerate. Once you add everything up, the average household will likely see increases in payments to the City of Thunder Bay ranging anywhere from 3 to 6 percent next year. It is indeed an elaborate dance of a thousand tax increases that our municipal councilors have begun to dance as they debate bits and pieces and hope nobody notices the big picture. Some of these component items have increased substantially.

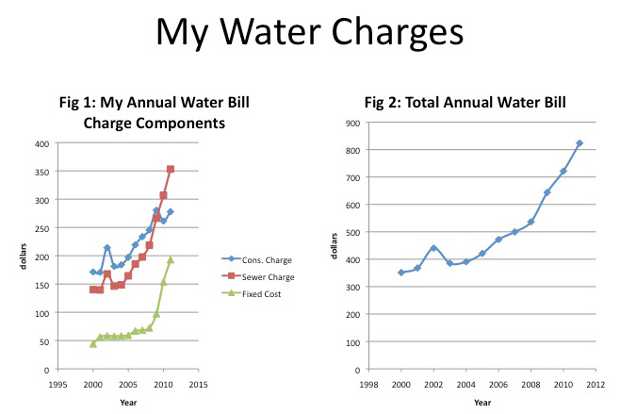

Take the example of the water bill. I decided to go back and look at my household water bills for the last decade – the period 2000-2011. The bill is divided into three components – a consumption charge, a sewer charge and a fixed cost which it turns out has been anything but fixed lately. Our consumption of water has been flat aside from the spike in 2002 (there was a leaky toilet that year which we then fixed). We’ve averaged about 241 cubic meters per year over the period 2000 to 2011 with no discernible upward trend.

Figure 1 shows the component charges for my water bill. They have all gone up over time. Over the period 2000 to 2011, my consumption charge has increased 62 percent, my sewer charge 152 percent and my “fixed cost” by 337 percent. Figure 2 adds all the charges up and between 2000 and 2011, my annual water bill has increased by 134 percent. I suspect that this pattern is common to most households in the city. Indeed, most households are probably afraid to consume less water and conserve because it would result in a revenue drop that would result in yet another rate increase, which our municipal overlords could creatively title the “Revenue Recovery Charge”.

Now to be fair, it can be argued that we were underpaying for water in the past as Canada in general has had some of the cheapest water rates in the world. But then, we do have a resource advantage in terms of the abundance of water. Also, building a new water treatment facility and modernizing our water system are also factors. We are paying for new infrastructure. Of course, that is why the call to renew yet more city infrastructure is so alarming given what has happened in the case of water. When it comes to municipal revenue and taxation, city councilors have created a tango of many fees and funds each of which results in an incremental increase but there is ultimately only one taxpayer footing the bill for these many separate fees. Who among our city councilors is looking out for the bigger picture when it comes to the impact on the average household?

Livio Di Matteo

Livio Di Matteo is an economist in Thunder Bay, Ontario specializing in public policy, health economics, public finance and economic history. Livio Di Matteo is a graduate of the Fort William Collegiate Institute (1898-2005) whose school motto “Agimus Meliora” has served as a personal inspiration. Livio Di Matteo holds a PhD from McMaster University, an MA from the University of Western Ontario, and an Honours BA from Lakehead University. He is Professor of Economics at Lakehead University where he has served since 1990. His research has explored the sustainability of provincial government health spending, historical wealth and asset holding and economic performance and institutions in Northwestern Ontario and the central North American economic region. His historical wealth research using census-linked probate records is funded by grants from the Social Sciences and Humanities Research Council of Canada. He has constructed, assembled and analyzed nearly 12,000 estate files for Ontario over the period 1870 to 1930. Livio Di Matteo writes and comments on public policy and his articles have appeared in the National Post, Toronto Star, the Winnipeg Free Press, Thunder Bay Chronicle-Journal, and NetNewsledger.com. Livio Di Matteo has had an entry in Canadian Who’s Who since 1995.

Livio Di Matteo is an economist in Thunder Bay, Ontario specializing in public policy, health economics, public finance and economic history. Livio Di Matteo is a graduate of the Fort William Collegiate Institute (1898-2005) whose school motto “Agimus Meliora” has served as a personal inspiration. Livio Di Matteo holds a PhD from McMaster University, an MA from the University of Western Ontario, and an Honours BA from Lakehead University. He is Professor of Economics at Lakehead University where he has served since 1990. His research has explored the sustainability of provincial government health spending, historical wealth and asset holding and economic performance and institutions in Northwestern Ontario and the central North American economic region. His historical wealth research using census-linked probate records is funded by grants from the Social Sciences and Humanities Research Council of Canada. He has constructed, assembled and analyzed nearly 12,000 estate files for Ontario over the period 1870 to 1930. Livio Di Matteo writes and comments on public policy and his articles have appeared in the National Post, Toronto Star, the Winnipeg Free Press, Thunder Bay Chronicle-Journal, and NetNewsledger.com. Livio Di Matteo has had an entry in Canadian Who’s Who since 1995.

This article was originally posted on Livio Di Matteo’s NORTHERN ECONOMIST Blog at http://ldimatte.shawwebspace.ca.